Reporting sold stocks & ETFs

Reporting sold stocks & ETFs

Bear in mind that capital gains and losses are all the user needs to report to tax authorities. If the user has invested but not sold any stocks or ETFs during the period he is issuing his tax report for, then no further action is needed on his part ! However, the user must report his Bitpanda account if he has not already done so. For a hassle-free reporting of his account, he can read our article here.

Reporting sold crypto assets

Reporting virtual dividends

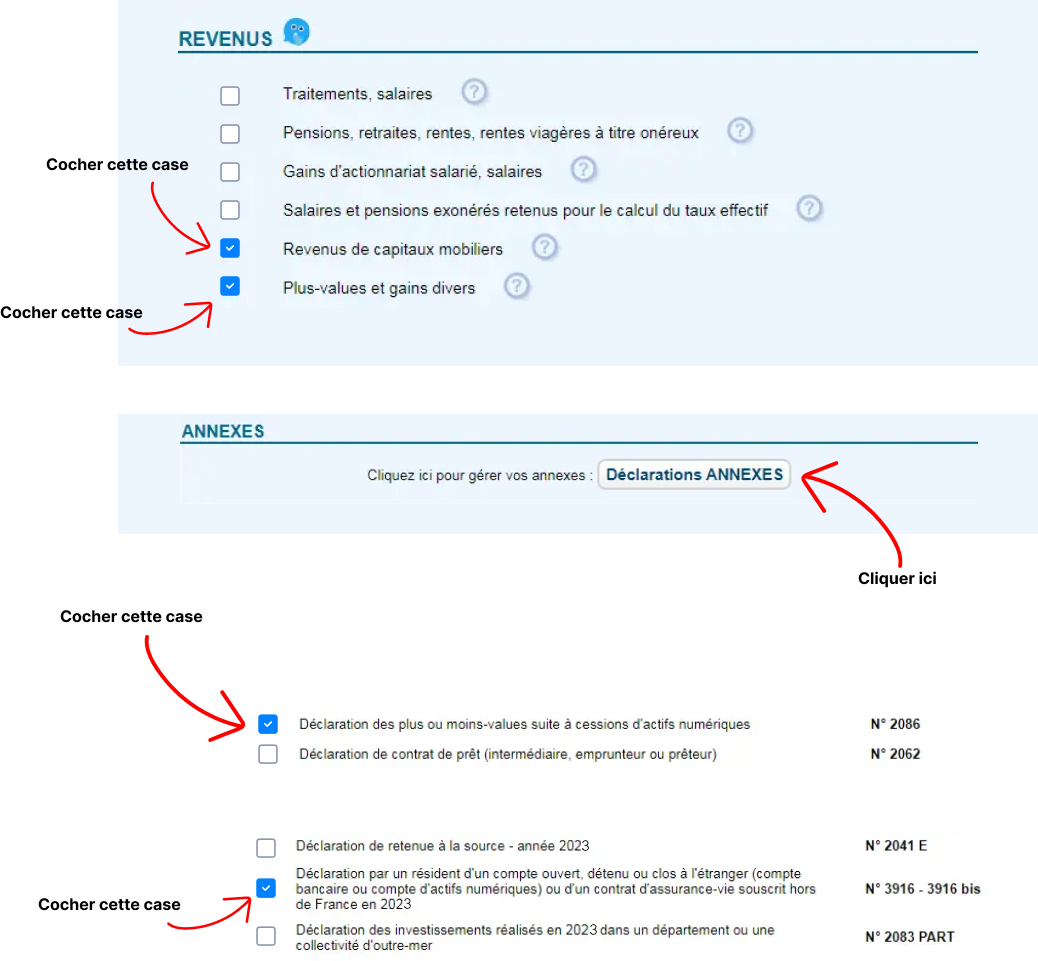

Step 1 : Getting the right forms ✅

The user has to tick the right checkboxes in order for the right forms to appear and click on the “Déclarations ANNEXES”.

See below:

In order to report the stocks and/or ETFs he sold, the user will have to fill forms 2047, 2074 and 2042.

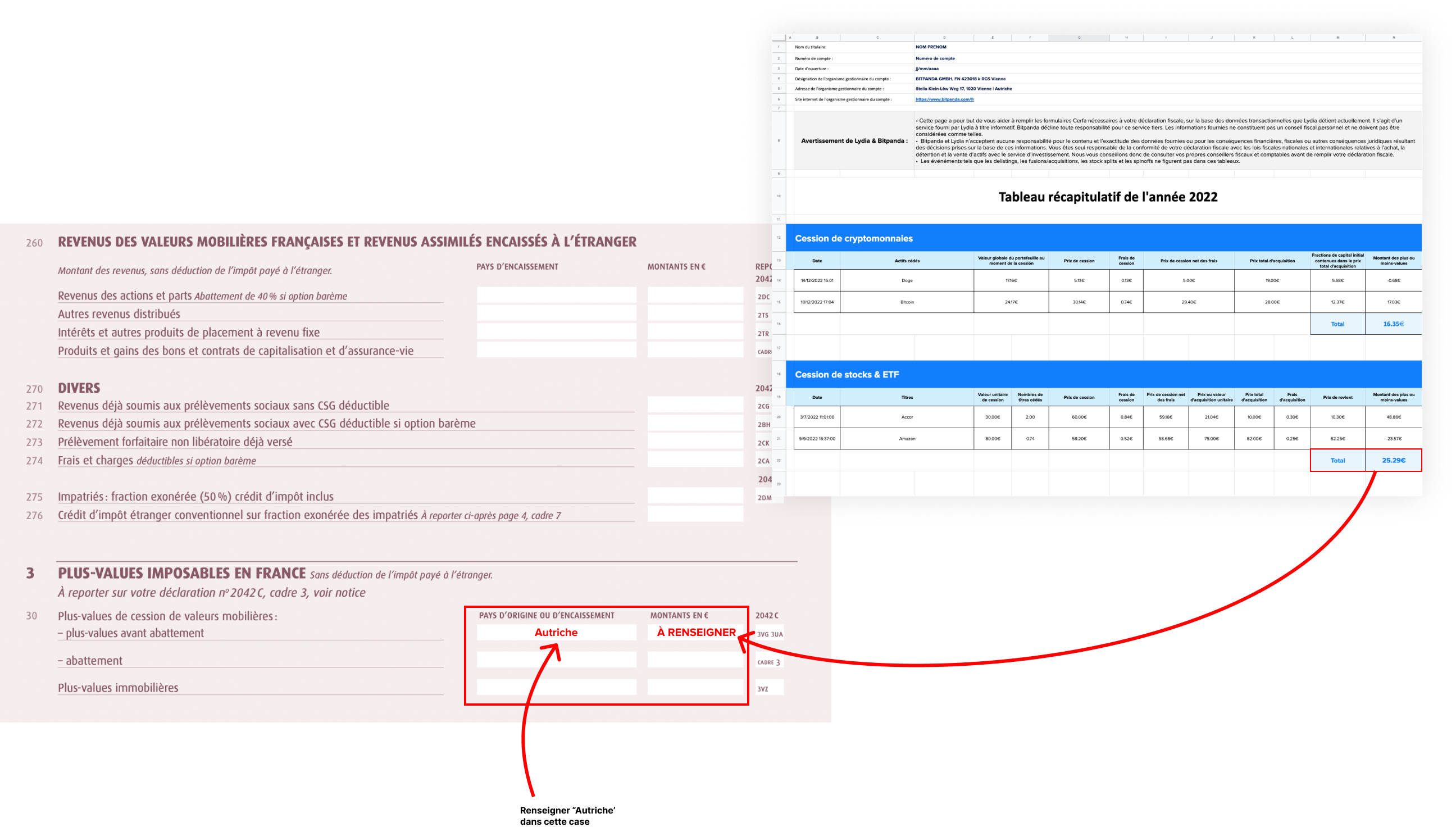

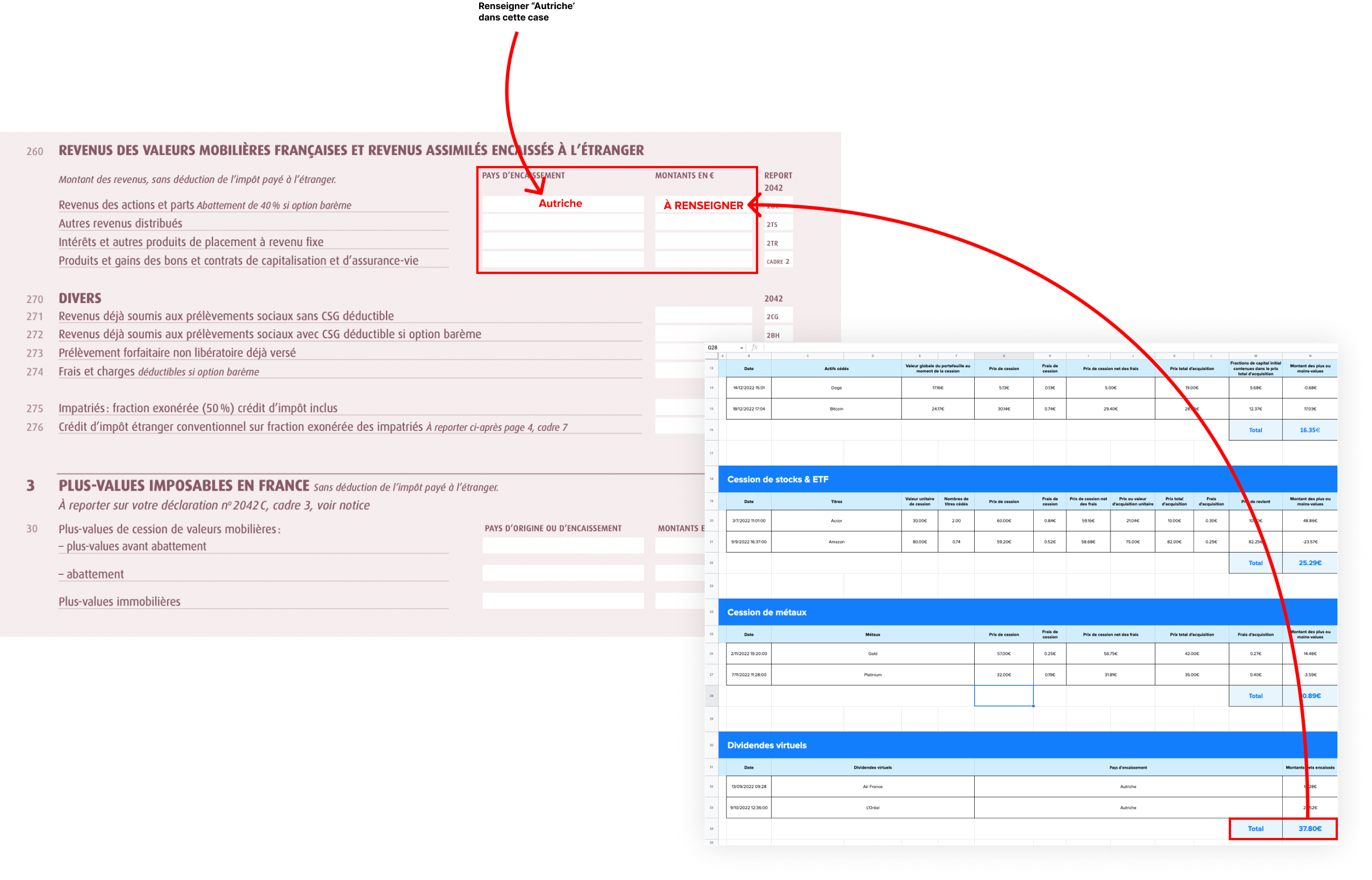

Step 2 : Completing form 2047 📝

First, the user will need the document sent to the email address you linked to his Lydia account. Second, he will also need the “Entreprises & ETF” spreadsheet.

- If the selling price was higher than the buying price, the user made a gain.

In which case, the user needs to write these gains in section 3 "PLUS-VALUES IMPOSABLES EN FRANCE"

The user must find the “Entreprises & ETFs” spreadsheet’s total amount (“montant total”) in his document to write in his report — only if the amount is positive. However, if the amount is negative, the user can skip this.

- If the selling price was lower than the buying price, the user incurred a loss. The user does not need to include it in this report.

However, the user will need to include dividends he may have earned on line 260.

Once the user filled out the total amount ("Montant total"), he must proceed with form number 2074.

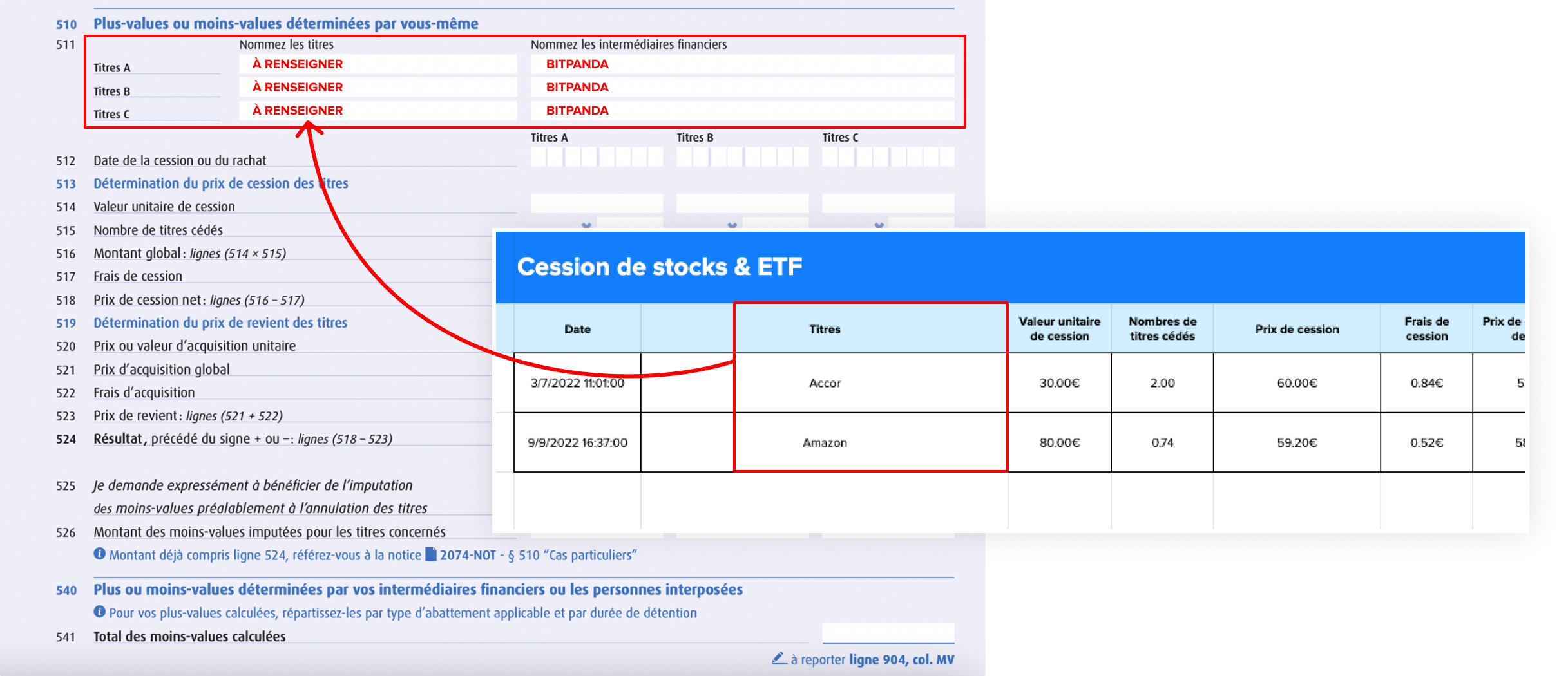

Step 3 : Completing form 2074 📝

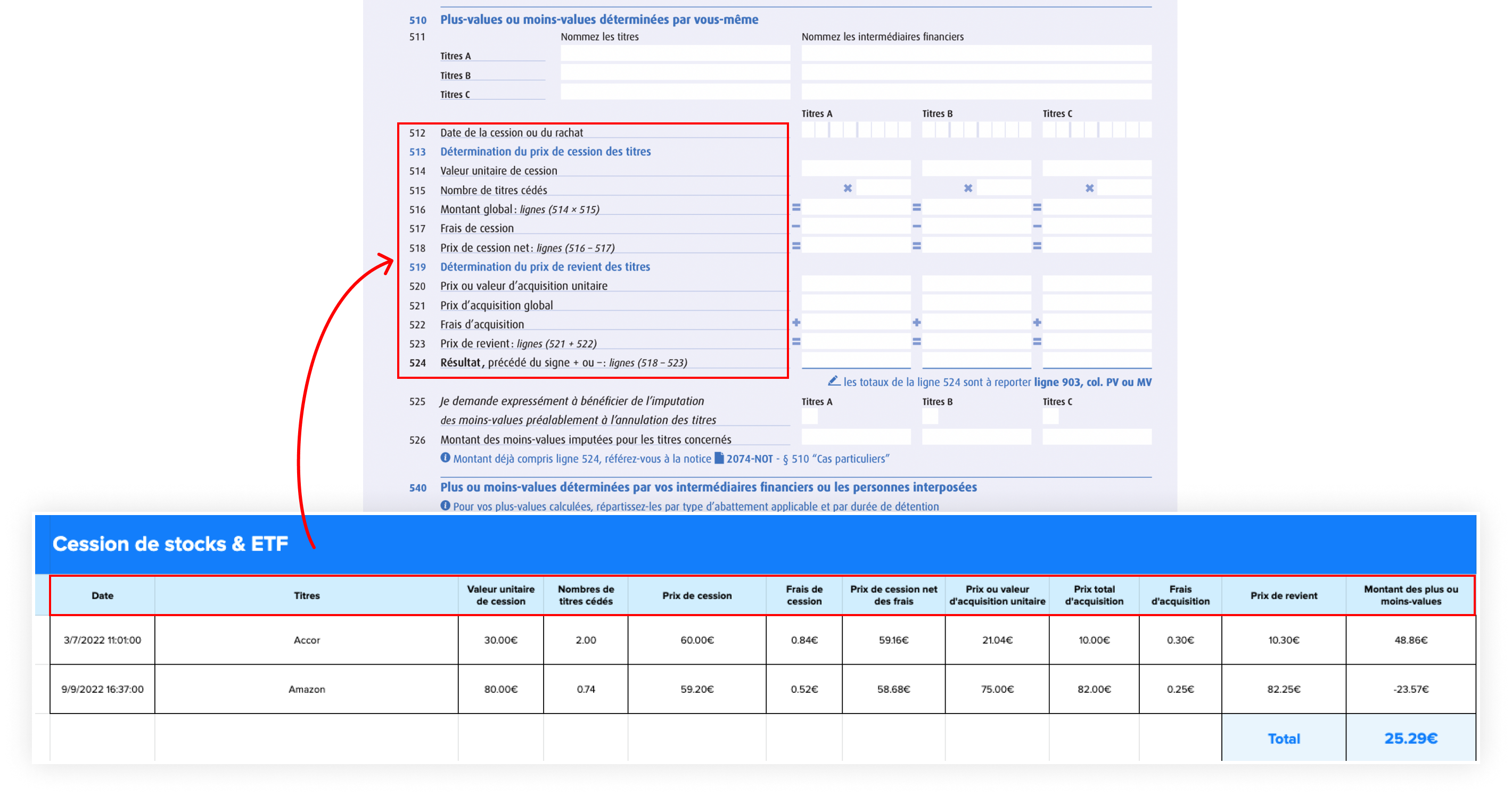

In section 511, the user must fill out the name of all the assets he sold during the period he is issuing his tax report for and always include "Bitpanda" as an intermediary ("intermédiaire financier").

Their names are listed in the recap spreadsheet in the “Entreprises & ETFs” section.

Then, for each asset and using his recap spreasheet, the user must fill out section 512 to 524.

- Use the section 540

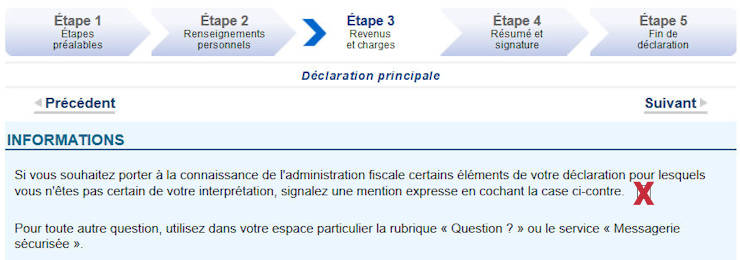

- Mention the following information in step 3 of his tax return ("Déclaration de revenus") :

- A comment in French explaining that the user was not able to fill out Section 510 because the system does not allow decimal values: “C’est bien le cadre 510 qui aurait dû être complété. Le système des Déclaration des impôts ne permet pas d’indiquer des opérations sur dérivés d’actions, celui-ci n’autorisant que les entiers d’actions et ne permettant pas de modifier manuellement le résultat du calcul." and detail the real capital gains or losses calculations :

What if the user incurred a capital loss ?

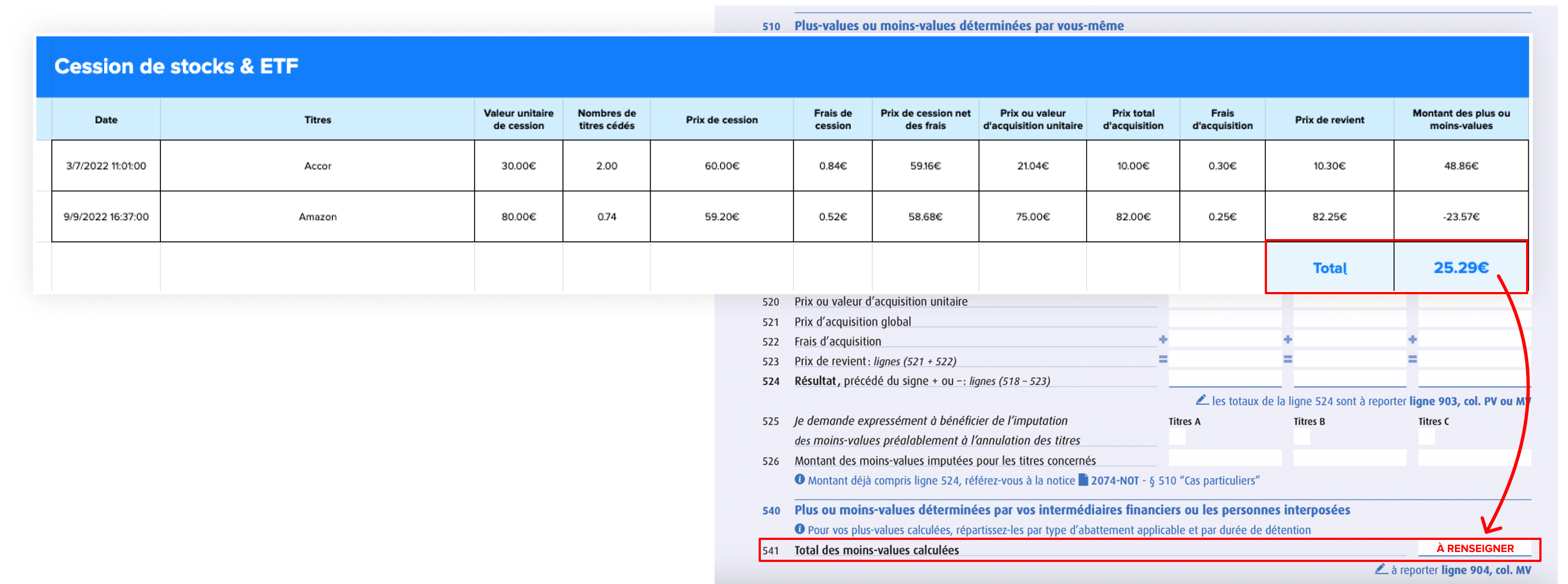

Section 541 : if the user incurred capital losses, he must fill out here their total amount.

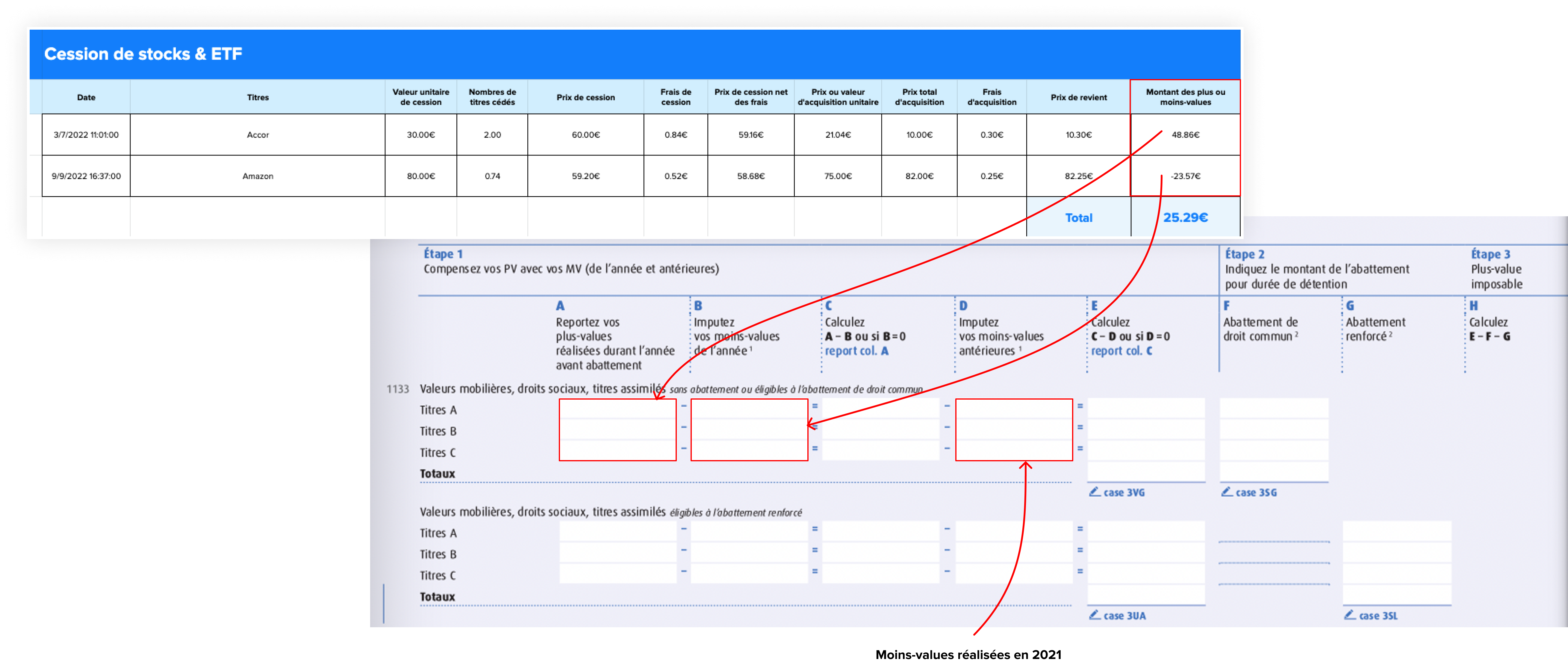

On the following page, the user must fill out columns as follows:

- Colonne A : total amount of capital gains

- Colonne B : total amount of capital losses

- Colonne C : A - B subtraction

- Colonne D : 2021 capital losses (checking the recap spreadsheet received last year)

- Colonne E : C - D subtraction

- Colonne F : do not fill out

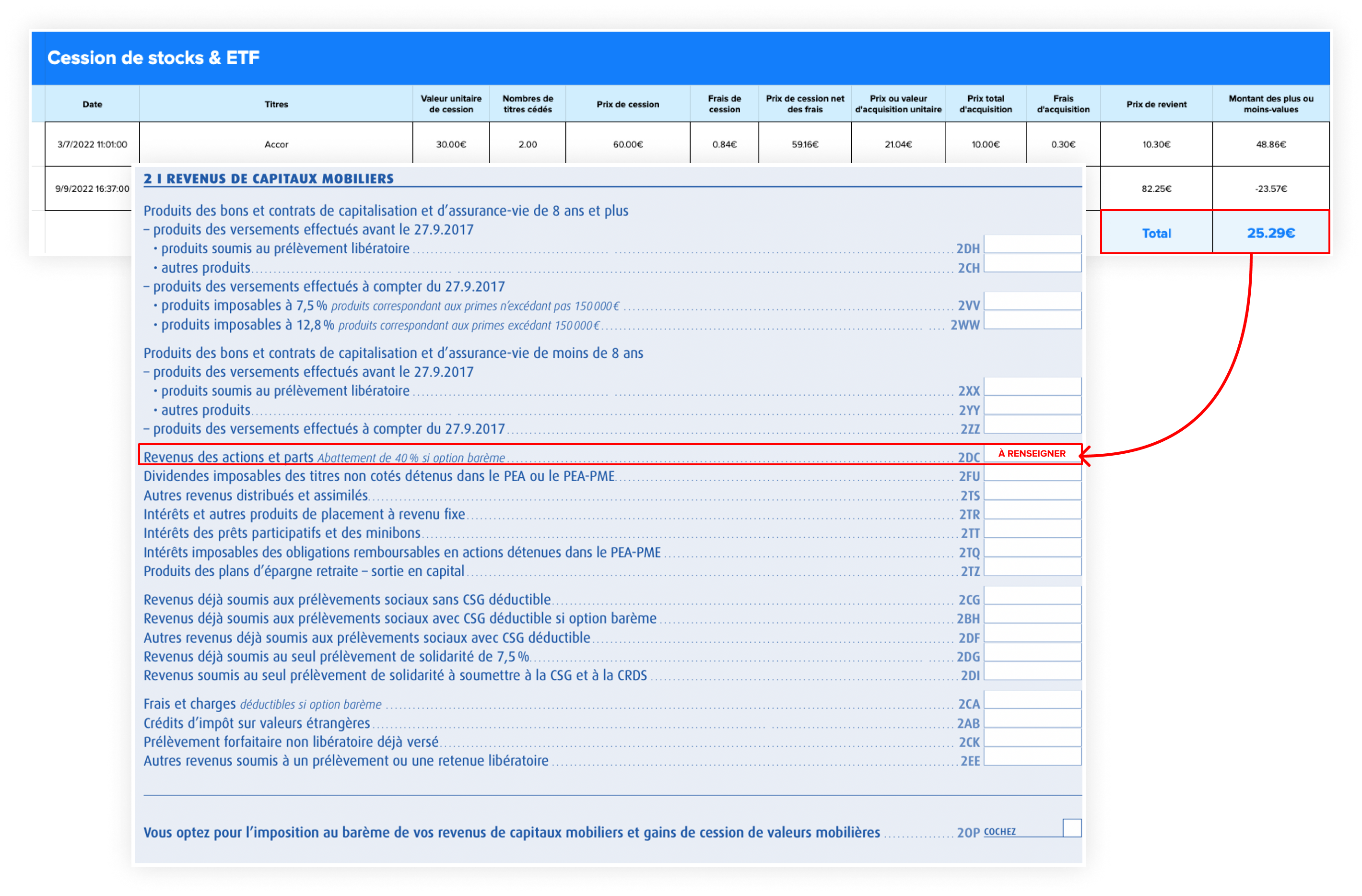

Step 4 : Completing form 2042 📝

If the user activated the automatic completion option on other forms, this form should already be filled out.

If it isn’t, then the user must fill out the 2DC line.

And voilà the user has reported his dividend yields! He must not forget his cryptocurrencies and dividends. If the user needs help reporting those, here are some articles that may help :