Declare sold crypto assets

Declare sold crypto assets

Bear in mind that capital gains and losses are all the user needs to report to tax authorities. If the user has not sold any crypto assets during the period he is issuing his tax report for, then no further action is needed on his part! However, the user must report his Bitpanda account if he has not already done so. For a hassle-free reporting of your account, the user can read our article here.

Reporting sold stocks & ETFs

Reporting virtual dividends

The user sold at least once ?

The user must fill out form number 2086 to report the crypto assets he sold.

Step 1 : Getting the right forms ✅

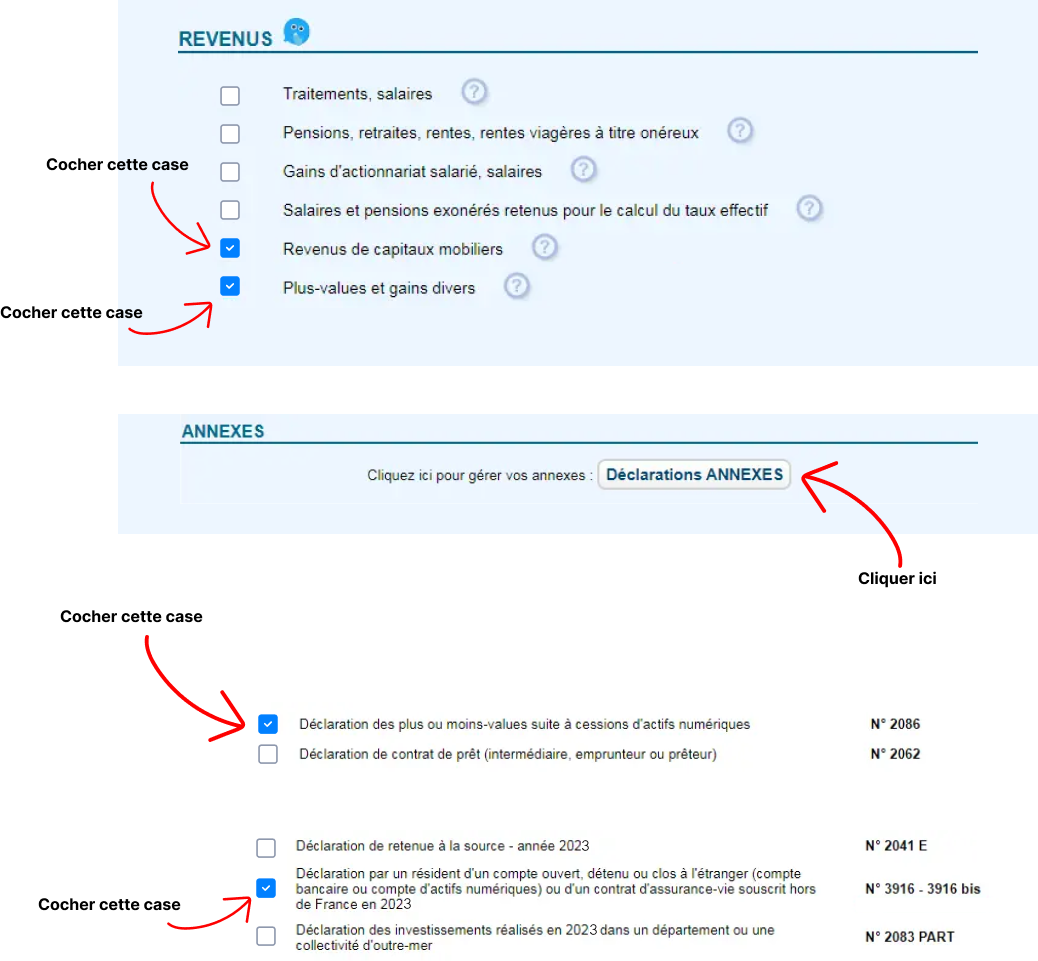

The user has to tick the right checkboxes in order for the right form to appear.

See below:

Step 2 : Completing form 2086 📝

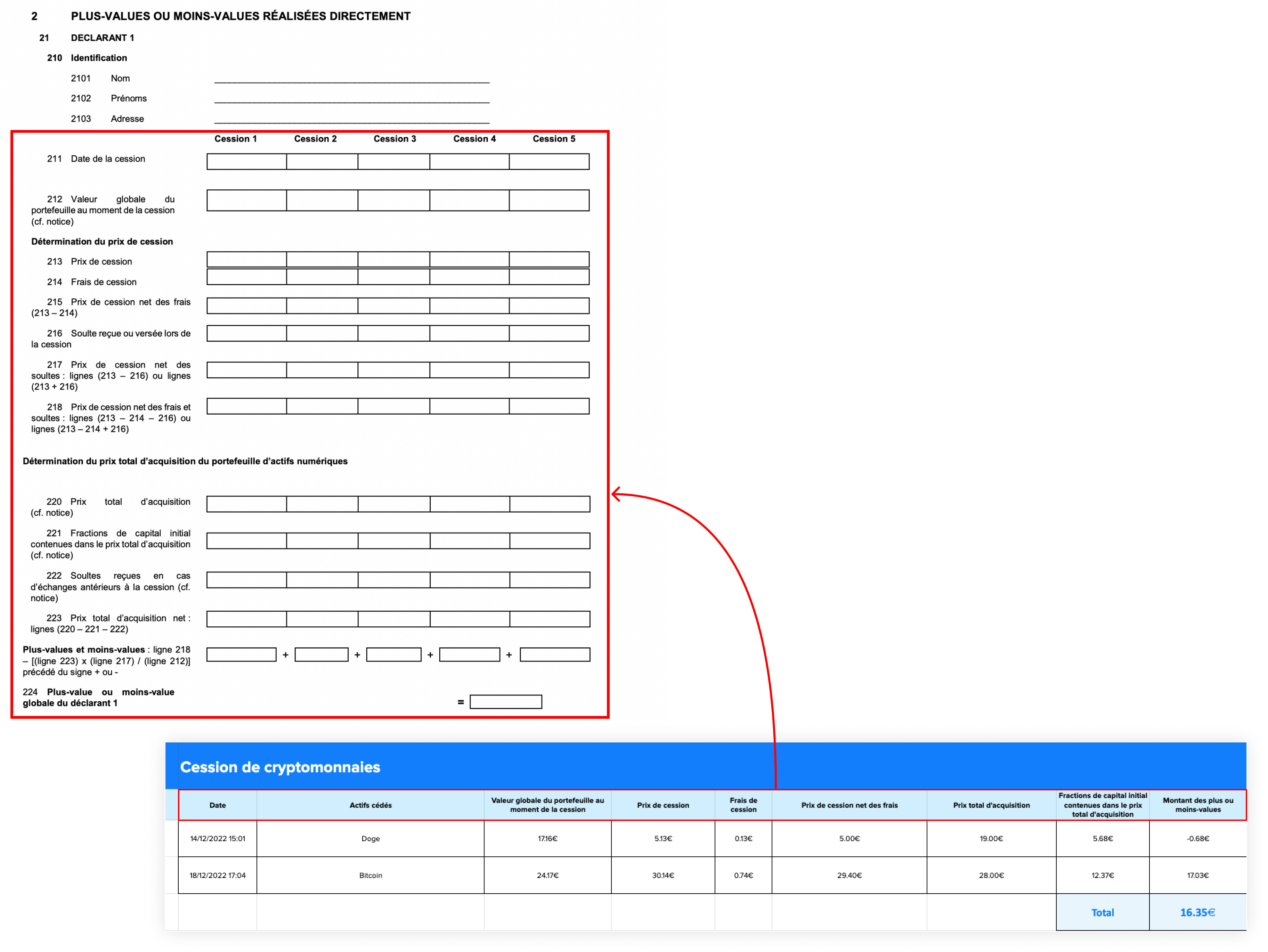

- The user fills out his personal information in section 210 :

- Last name

- First and middle names

- Address

- The user fills out lines 211 to 224 using the recap spreasheet received via email.

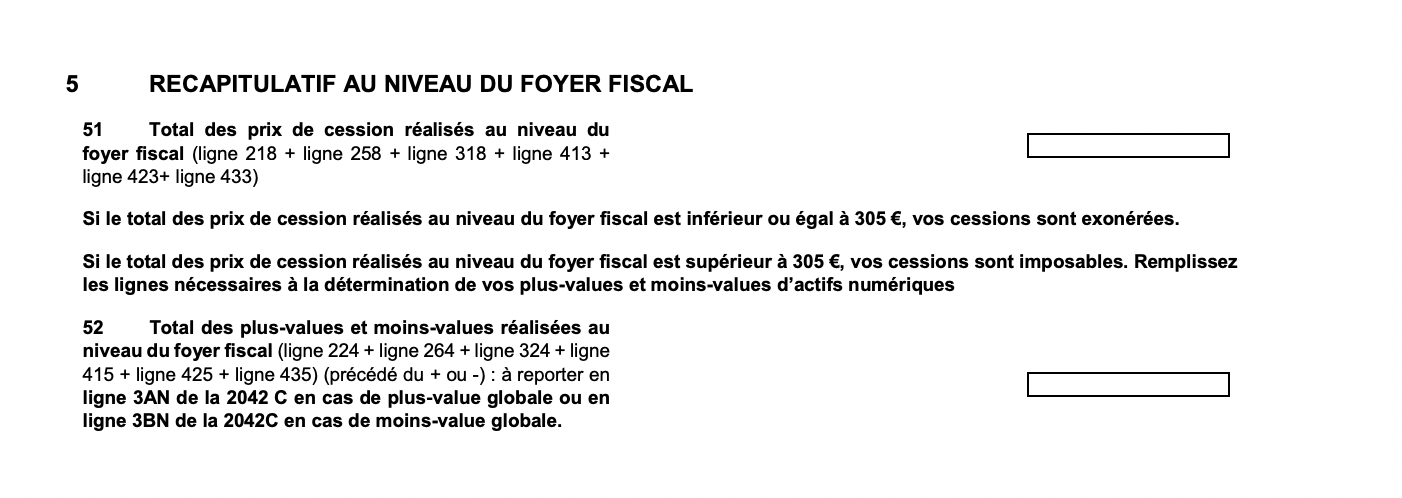

- In section 5, the user fills out the following boxes :

- 51 = line 218 + 413

- 52 = line 224 + 415

And voilà the user is done reporting his crypto assets! Don’t forget your sales of stocks, ETFs, and received dividends. If the user needs help reporting those too, here are some articles that may help: